DON’T MISS THIS OPPORTUNITY

If you’re a history buff, the subject of this email may look familiar. It’s a play on the famous Naval quote from Admiral David Farragut who yelled, “Damn the torpedoes. Full speed ahead!” as he sailed his Union squadron into the Confederate-held and highly-torpedoed (now called mines) Mobile Bay during the Civil War. His fearlessness in the face of great danger ultimately led the Union Navy to victory and was a pivotal turning point in the war. I frequently heard this quote throughout my 14 years in the U.S. Navy and I believe it’s applicable to today’s real estate market.

First, we are navigating uncharted waters and understanding history can help us uncover clues about the future. Second, today’s interest rates and market volatility are akin to mines. Unlike in Admiral Farragut’s days, we have tools and resources to navigate the heavily-mined interest rate waters and treacherous economic conditions to achieve victory.

We are in the midst of a market shift and have been since late spring. If you are a news reader, the headlines are overwhelmingly negative and it is causing a lot of fear and uncertainty to take hold. If you let headlines sway your decision-making, you risk losing sight of the opportunities that lay before you.

As your trusted real estate advisor, I believe this market is one of the greatest opportunities for real estate wealth creation, but it won’t last forever. Here’s why:

Inflation And Mortgage Rates Are Connected

Inflation is the 2022 buzzword because it is eroding our purchasing power. Mortgage lenders need to overcome this erosion with higher interest rates. However, throughout the pandemic, the Federal Reserve (the Fed) kept interest rates artificially low by injecting stimulus into the economy through a process called Quantitative Easing (QE). Once QE stopped in spring 2022, mortgage rates swiftly and steeply rose towards the level of inflation.

Inflation is the 2022 buzzword because it is eroding our purchasing power. Mortgage lenders need to overcome this erosion with higher interest rates. However, throughout the pandemic, the Federal Reserve (the Fed) kept interest rates artificially low by injecting stimulus into the economy through a process called Quantitative Easing (QE). Once QE stopped in spring 2022, mortgage rates swiftly and steeply rose towards the level of inflation.

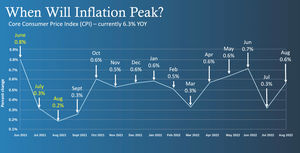

Signs Show That Inflation Has Likely Peaked Already

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Today’s overall CPI number is determined by adding up the monthly CPI readings from the past twelve months. Moving forward, we know that key inflationary pressures (like supply chain constraints and shelter costs) are easing and we expect monthly readings to come in lower. High monthly readings from October-February 2021 will drop off the calculation, lowering overall CPI.

When Inflation Drops, Mortgage Rates Will Follow

When November’s CPI report was released, inflation came in even lower than expected. The result? A historic one-day drop in mortgage interest rates as shown in the rate breakdown above. As higher 2021 monthly CPI numbers fall off the overall calculation, we expect mortgage rates to follow.

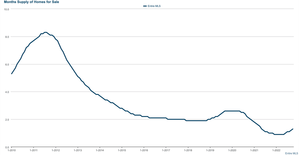

Available Home Inventory Is Higher, But It Is Still Historically Low

The drastic and swift rise in interest rates caused buyers to hibernate and sellers to go on strike. Although inventory is up 115% year-over-year, it is still historically low and below pre-pandemic levels. Low supply is keeping prices high. The market is correcting, but it is nowhere near crashing.

Further, new home builders have pulled back on building due to higher interest rates. New household formations exceed the supply of available home inventory. This means that the core housing problem (excess demand and too little supply) isn’t being addressed through the Fed’s monetary policy, and, in fact, is being exacerbated by it because new homes aren’t being built at the pace we need them to be.

Once rates drop into the 5% and below range, we will have a slew of home buyers unleashed into a low inventory market. It’s unlikely that inventory will drop to early 2022 numbers, but it is likely we will see an increase in multiple offer situations and we know that leads to rising home prices.

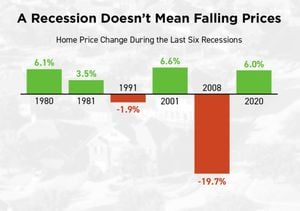

Recession Red Flags Are All Around

When you hear that the Fed is increasing interest rates, it is raising short-term interest rates like credit cards, car loans, and HELOCs, and it is not directly raising mortgage rates (remember, inflation drives mortgage rates). The Fed raises rates to slow down a hot economy. Businesses are often impacted first by the Fed’s rate hikes, which leads to the job losses we are now beginning to see, especially in the tech sector.

There’s debate about if we are currently in a recession. A significant majority of experts believe a recession is imminent if we are not already in one. Not only does history show us that low unemployment precedes a recession, it also shows us that mortgage rates drop and housing prices typically appreciate during a recession. This upcoming recession will be a job loss recession, not a recession initiated by the housing market like the Great Recession in 2008 (the Fed is targeting an unemployment rate in the mid-4% range, up from ~3.7% today).

So here’s what this all means for you:

Buyers: Gone are the days of bidding wars, appraisal gaps, and waived inspection items. Not only are there a lot more homes to choose from, but you can negotiate the purchase price, receive seller concessions to lower your interest rate, and have the seller address inspection items for you. These options didn’t exist earlier this year! It is a much more balanced and calm purchasing situation now. Don’t be deterred by higher interest rates because they are temporary and there are lenders who will refinance your mortgage for free after you close.

Sellers: Sales prices are down ~10% from the spring. Your initial reaction may be despair, but let’s put this into context – you have gained an unprecedented ~27% in home equity since October 2019.

- If you are a seller who must sell, your home needs to be as turnkey as possible. When it shows well and is priced right, you will get an offer fairly quickly.

- If your home is unique and/or in a desirable location, you may even receive multiple offers. If you don’t have to sell right now, let’s talk about preparing your home to go on the market next year. The time and money you invest over the coming months will create a return, and simple updates like fresh paint and new carpet can transform your home and your asking price. As we saw last week, rates can drop quickly and inventory will follow so it’s important to be ready to strike when the iron is hot.

- The next few months are an incredible time to upgrade or to downsize. You can get a fair price for your home, you have lots of homes to choose from, and you have breathing room to make decisions.

Investors: Although Warren Buffet isn’t known for his real estate investing, he is famous for saying, “Be fearful when others are greedy, and be greedy when others are fearful.” There are A LOT of investors who are taking advantage of the fear present in the market and scooping up homes at a discount. If you are an active investor or are thinking of dipping your toes into investing, let’s chat. Owning investment properties is a great way to diversify your portfolio, create your own pension through passive income, and save for retirement.

If you bought in the first half of 2022: Hearing that a market correction is happening may be cause for alarm, but it’s only a problem if you have to sell. Markets go up and markets go down, but history shows us that they always go up. Plus, you may have an interest rate you may never see again in your lifetime and you were probably able to afford more home than you would be able to today or next year.

Cue the Counting Crows:

“Don’t it always seem to go, that you don’t know what you got ’till it’s gone.”

“Don’t it always seem to go, that you don’t know what you got ’till it’s gone.”

There is no reason to be fearful of this new market and I hope you now see the opportunity that lays before you over the upcoming months. Don’t let it slip away!

As you can probably tell by now, I love diving into the data and uncovering opportunities for my clients. If you or someone you know has any questions or would like to strategize, please reply to this email, give me a call/text (720-636-6238), or schedule some time on my calendar. And if I don’t see you next week, I hope you have a wonderful Thanksgiving!

Lauryn Dempsey