Don’t Miss The Interest Rates and Business Value Opportunity

If you’re a history buff, the subject of this email may look familiar. It’s a play on the famous naval quote from Admiral David Farragut, who famously yelled, “Damn the torpedoes. Full speed ahead!” as he led his Union squadron into the Confederate-held and highly-mined Mobile Bay during the Civil War. His fearlessness in the face of great danger ultimately led the Union Navy to victory and marked a pivotal turning point in the war. Having served 14 years in the U.S. Navy, I’ve heard this quote countless times, and I believe it perfectly applies to today’s real estate market.

We’re currently navigating uncharted waters. But understanding history can help us uncover clues about the future. Today’s interest rates and market volatility are akin to mines. Unlike Admiral Farragut, we now have tools and resources to navigate the heavily-mined interest rate waters and treacherous economic conditions to achieve victory in real estate.

We’ve been in the midst of a market shift since late spring. If you’ve been reading the news, the headlines are overwhelmingly negative, and they’re causing fear and uncertainty to take hold. If you let these headlines sway your decision-making, you risk losing sight of the opportunities that lay ahead.

As your trusted real estate advisor, I firmly believe that this market presents one of the greatest opportunities for wealth creation in real estate. However, this won’t last forever. Here’s why:

Inflation And Mortgage Rates Are Connected

Inflation has been a buzzword for much of 2022, and it’s eroding our purchasing power. Mortgage lenders need to adjust for this erosion by raising interest rates. However, throughout the pandemic, the Federal Reserve (the Fed) kept interest rates artificially low through a process known as Quantitative Easing (QE), where stimulus was injected into the economy. Once QE stopped in spring 2022, mortgage rates began to rise swiftly, matching inflation levels.

The connection between inflation and mortgage rates is clear. The higher the inflation, the higher the rates have to go to offset it. But there’s good news: understanding this dynamic gives us the foresight to plan for when rates begin to drop again, which brings us to the next point.

Signs Show That Inflation Has Likely Peaked Already

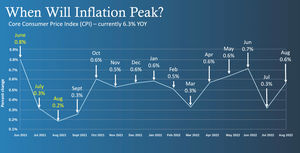

The Consumer Price Index (CPI) is one of the primary indicators of inflation. It tracks the average change over time in the prices paid by consumers for a basket of goods and services. Moving forward, we know that several key inflationary pressures, such as supply chain constraints and shelter costs, are beginning to ease. As these pressures decrease, we expect the monthly CPI readings to come in lower, which will lower the overall inflation rate.

As the high inflationary months from October through February 2021 drop out of the CPI calculation, we will likely see a reduction in inflation. This could lead to a drop in mortgage rates, which would be beneficial for buyers and sellers in the real estate market.

When Inflation Drops, Mortgage Rates Will Follow

When the CPI report in November showed that inflation had come in lower than expected, we saw a historic one-day drop in mortgage interest rates. As high CPI numbers from 2021 fall off the calculation, mortgage rates are expected to continue following inflation down.

What does this mean for you? For buyers, lower mortgage rates will lead to more affordable financing. For sellers, it will lead to more buyers entering the market, and this can ultimately drive prices up again.

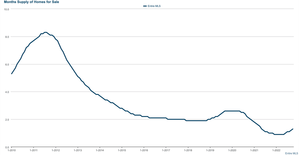

Available Home Inventory Is Higher, But It Is Still Historically Low

While home inventory is up by 115% year-over-year, it’s still historically low and remains below pre-pandemic levels. This limited supply is contributing to the continued high prices we are seeing. The rise in interest rates has caused many buyers to hold off, while sellers have also pulled back. New home builders, who are also impacted by rising rates, have slowed production, which further exacerbates the housing supply issue.

As interest rates decrease in the future, we will likely see a surge in buyer activity. This is because new home buyers will be able to enter a market with limited inventory, leading to bidding wars and rising home prices.

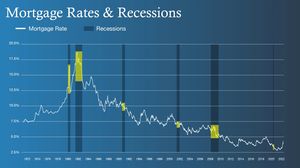

Recession Red Flags Are All Around

When you hear that the Fed is increasing interest rates, it’s important to remember that they’re raising short-term interest rates like those for credit cards, car loans, and HELOCs, but mortgage rates are primarily driven by inflation. The Fed raises short-term rates to slow down a heated economy, and businesses are typically impacted first by these rate hikes. This is leading to job losses, particularly in the tech sector.

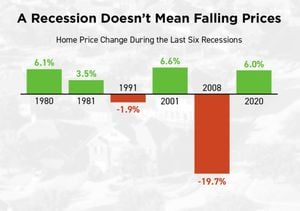

There is debate over whether we are currently in a recession. A significant majority of experts believe a recession is imminent if we are not already in one. The reason? Historically, low unemployment rates often precede recessions, and mortgage rates typically drop during a recession. Additionally, home prices tend to appreciate during recessions, as we saw in the 1990s and 2000s.

This upcoming recession is expected to be a “job loss” recession, not a housing-led recession like the Great Recession of 2008. The Fed is targeting an unemployment rate in the mid-4% range, up from the current rate of around 3.7%.

So here’s what this all means for you:

Buyers: Seize the Opportunity

Gone are the days of bidding wars, appraisal gaps, and waived inspection contingencies. There are now more homes to choose from, and you have the power to negotiate the price. You can request seller concessions to help lower your interest rate, and have the seller address inspection items. These options were simply not available earlier in the year. The market is much more balanced and calm now, so don’t be deterred by the current interest rates. They are temporary, and refinancing options are available for free after closing.

Sellers: Don’t Panic, Your Equity is Still Strong

Yes, home prices have dropped by approximately 10% since the spring, but let’s put this into context. Since October 2019, you’ve gained an unprecedented 27% in home equity. While the market has shifted, the equity you’ve built over the last few years is still strong.

If you are a seller who must sell, your home needs to be in the best possible condition and priced right. Homes that are turnkey and well-maintained are likely to sell quickly, even in a slower market. If you’re in a desirable location or have a unique property, multiple offers are still possible.

If you don’t have to sell immediately, consider waiting for the market to improve. Simple updates like fresh paint and new carpet can make a big difference in your home’s sale price. Be prepared to strike when mortgage rates drop and inventory follows suit.

Investors:

Warren Buffet may not be a real estate investor, but he is famous for saying, “Be fearful when others are greedy, and be greedy when others are fearful.” Many investors are taking advantage of the fear in the market to scoop up properties at a discount. If you’re an active investor or considering starting, now is the perfect time to discuss strategies. Real estate is an excellent way to diversify your portfolio, generate passive income, and build wealth for retirement.

For Those Who Bought in 2022: Stay Calm

If you bought a home in early 2022, hearing about a market correction may be alarming. However, it’s only a problem if you need to sell right now. Markets go up and down, but they always recover. Plus, if you have a low interest rate, you might be holding onto a rate you may never see again. You likely secured more home than you would be able to afford at current rates, which gives you a strong position for the future.

Frequently Asked Questions

- How will rising interest rates affect home prices?

Rising interest rates can make it more difficult for buyers to afford homes, which may lead to a slight dip in prices. However, low inventory and strong demand are still driving prices up, especially in sought-after neighborhoods. - Should I buy a home now with higher interest rates?

If you’re in a position to buy, the market is still full of opportunities. You can negotiate better prices and seller concessions. Additionally, interest rates are temporary, and you can refinance once they drop. - Is it a good time to sell my home in this market?

If you need to sell, it’s important to price your home competitively and make sure it’s in top condition. You may not see the peak prices from earlier in the year, but you can still make a significant profit with proper preparation. - What should I do if I’m an investor in this market?

This is a great time to consider buying properties at discounted prices. Look for deals in undervalued markets and take advantage of the fear-driven opportunities in the market. - How can I stay ahead of the market in this economic climate?

Staying informed and strategic is key. Work with a knowledgeable real estate agent to understand market trends, negotiate effectively, and make informed decisions that align with your long-term goals.

The Opportunity Ahead

Just like Admiral Farragut’s charge into Mobile Bay, we have a tremendous opportunity in front of us, and it requires fearlessness and strategic action. With interest rates likely to drop, home prices potentially rising again, and inventory still low, those who act strategically now can position themselves for long-term success.

The next few months are an incredible time to buy, sell, or invest in real estate. If you’re ready to strategize and seize this opportunity, contact us and let’s connect. My team and I in the Dempsey Group are here to guide you through the data and uncover the best opportunities to grow your wealth in this market.

The current market may seem daunting, but it’s full of opportunity for those who are willing

“Don’t it always seem to go, that you don’t know what you got ’till it’s gone.”