Understanding Volatile Economy and the Current Market Dynamics

It can be hard to keep up and understand how to interpret this volatility. Here are my takeaways:

- Demand exceeds supply and will keep prices elevated. Demand for homes continues to exceed supply, and this imbalance is likely to keep prices elevated. To offset demand in our market, we would need to have over 28,500 homes listed for sale. Currently, we have approximately 3,695 active listings across seven counties that represent a total population of around 2.9 million people. Turnkey homes that are priced right are seeing multiple offers due to low supply. This creates a competitive environment for buyers, particularly for well-maintained properties that meet current market expectations.

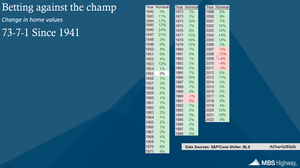

- Remember, real estate is long term. When we look to history, home prices have appreciated 73 years out of the past 81 years! Investing in hard assets like real estate is a smart move. Further, history tells us that real estate appreciates during recessions. Of the last six recessions, Denver real estate values have appreciated during five of them. This resilience is a strong indicator of the long-term stability that real estate can provide, making it a safe haven for investment even in uncertain economic times.

- Volatility can mean opportunity for buyers. While a volatile economy might seem daunting at first glance, it can also present unique opportunities for buyers. When you look beyond the headlines and dig into the data, you will uncover an economic story that shows signs of a slowing economy. As inflation drives mortgage rates, a decrease in inflation typically leads to lower rates. Buyers who enter the market during these volatile times have a higher likelihood of being able to negotiate concessions and rate buydowns from sellers today. This presents a unique chance to secure favorable terms and refinance into lower long-term rates in the future.

- Banking failures are inherently deflationary.Banking failures are inherently deflationary. While we don’t yet know the long-term impacts of these failures, the immediate effect was a drop in interest rates, providing some relief to potential borrowers. In the future, however, access to credit could be tightened, which is also deflationary. It’s important to keep an eye on the evolving landscape of banking and credit availability, as these factors will directly impact the real estate market.

Staying Informed On a Volatile Economy

Real estate has had a strong track record of positive home price appreciation since 1941. A prime example of this growth is happening in Aurora, which is Colorado’s fifth-largest city and is growing rapidly. The northeast portion of Aurora is often referred to as the “Emerging Aerotropolis,” an area where the city is actively working to retain, attract, and expand business and employment opportunities for its community.

With 15 new developments in the works, the city is heavily invested in creating environments where businesses can thrive by melding business and residential communities together. Its focus on transit-oriented development, urban renewal/redevelopment, retail, residential, and industrial/office spaces is making Aurora an attractive place to call home. This growth not only supports a stronger local economy but also enhances the value of real estate in the area.

Frequently Asked Questions

- What factors contribute to the volatility of the economy?

Economic volatility can be influenced by various factors, including changes in monetary policy, inflation rates, employment data, banking stability, and global economic events. Understanding these factors can help you better navigate the real estate market. - How can I benefit from buying a home in a volatile market?

Buying a home in a volatile market can provide opportunities for negotiation and favorable terms. If you enter the market during times of uncertainty, you may be able to secure concessions from sellers and benefit from lower prices before rates stabilize. - Should I be worried about rising interest rates?

While rising interest rates can impact affordability, they can also lead to increased competition for homes. Understanding your financial situation and exploring loan options can help you make informed decisions regardless of rate fluctuations. - How does historical data support real estate investment during economic downturns?

Historical data shows that real estate values tend to appreciate during economic downturns. In the last six recessions, Denver real estate values have appreciated in five, demonstrating that real estate can be a stable and reliable investment over time. - What steps should I take if I want to sell my home in a volatile economy?

If you plan to sell your home in a volatile economy, it’s essential to work with an experienced real estate agent who understands current market dynamics. Consider pricing your home competitively, enhancing its appeal through staging and improvements, and being prepared to negotiate with potential buyers.

Taking Advantage of Local Resources

If you are looking for quick hits on the market, follow me on LinkedIn to get daily insight. If I can help you strategize your next steps in real estate in the Denver metro or elsewhere across the U.S., please reply or book a call with me! I strive to provide valuable information that can help you stay informed about market trends, tips for buying and selling, and the overall economic landscape. If I can help you strategize your next steps in real estate in the Denver metro area or elsewhere across the U.S., please reply or book a call with me!

It’s Spring Break!

The Future is Bright

As we navigate through this volatile economy, it’s essential to remain adaptable and proactive. The current market conditions may present challenges, but they also offer opportunities for growth and success. Whether you are a buyer, seller, or investor, understanding these dynamics is crucial for making informed decisions.

Final Thoughts

As we move forward, let’s stay informed and engaged with the evolving real estate landscape. With the right strategies and insights, we can turn the challenges of a volatile economy into opportunities for growth and success. The Dempsey Group are here to support you on your real estate journey—reach out with any questions or for personalized guidance tailored to your unique situation. Together, we can navigate the path to achieving your real estate goals, regardless of market conditions.

If you were forwarded this email and would like to get my updates directly, click here to join my mailing list.

Connect with me on social media and stay in the know with market updates

If you are looking for real-time info on the local real estate market, follow Lauryn Dempsey on LinkedIn to get daily tips and insight. If Lauryn can help you strategize your next steps in real estate in the Denver Metro Area or elsewhere across the U.S., please book a call!