It’s been a wet and cool spring, but that hasn’t impacted the local real estate market. In just one month, average and median home prices both rose about 2.5% in the Denver metro area, equivalent to a $15k appreciation for a house priced at $580k (which is our median sales price). Despite being ~5-6% down from last year’s peak, given the sluggish start to the spring selling season, it will be fascinating to observe how these numbers evolve later this summer when interest rates begin their march downward.

Your home insurance bill might look scarier than usual – but you’re not alone. I have received quite a few insurance questions over the past month and recently spoke to a few insurance experts for more insight into what’s going on. Here’s what they had to say:

Home insurance costs are increasing due to rising construction costs. Essentially, your policy’s coverage must match the expense of rebuilding your home, which has surged due to increased demand and limited supply of construction materials post-pandemic.

To illustrate, suppose you purchased a house in 2017 for $350,000, insured at a limit of $400,000. Today, due to inflation in construction costs, you might need $500,000 to rebuild it. This is exactly why insurance companies are updating policies, leading to higher bills.

There’s no fixed amount or percentage to estimate this increase, as it will depend on your location, age of your policy, home improvements, and other factors. While these changes can be jarring, remember that they’re to ensure you won’t be left with hefty bills if disaster strikes as was the case for some Marshall Fire victims.

If you’ve been with the same insurance carrier for a little while, it may be time to review your policy. While most policies have inflation protection that help with rising construction costs, there may also be additional coverages available that weren’t an option when your policy was originally written.

Further, home insurance in Colorado is some of the most expensive in the country and it could be best to shop around to save money. Even if you prefer to stay with your carrier, it’s important to review insurance coverage annually, especially in the aftermath of the Marshall Fire and what will most likely be a hot, red flag-filled summer.

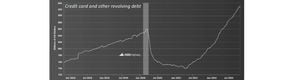

A new report from Black Knight found that Americans have ~$185k in tappable equity in their homes. Despite enjoying record-low mortgage interest rates and high equity, many Americans are burdened with high credit card debt and skyrocketing auto loans. Add in a drastic increase in property taxes and home insurance for us here in Colorado and you may feel like your living situation has become unaffordable.

If you find yourself in this situation and are a homeowner, please know you have options. Contrary to popular belief, your very low mortgage rate may be doing more harm than good right now and a cash-out refinance may bring some financial relief. Here’s how:

Using some of your home equity to clear debt will likely increase your mortgage rate, but it could actually balance out your monthly household budget. You may even find that your monthly expenses could go down if you take this approach. With lower rates on the horizon, refinancing to a lower mortgage in the near future could help bring monthly costs even lower.

At the end of the day, my goal is to help you stay in your home if that’s what you want. If you are interested in exploring your options, please reply to this email and I will connect you with a trusted mortgage professional.