MULTIPLE OFFERS ON A HOUSE: THE MARKET IS RAMPING BACK UP!

- Inventory has dropped by 17.7%

- Days on market has dropped by 16.3%

- Total showings have increased by 14.5%

- Nationally, mortgage demand jumped 28% in the past week

- Homebuilder sentiment has risen for the first time in 12 months

Multiple Offers on a House for More Opportunities

HOW ARE YOU PREPARING FOR A RECESSION?

- Mortgage rates are driven by inflation. As inflation drops, so will mortgage rates.

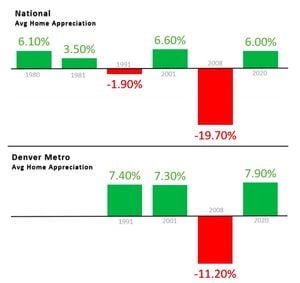

- Real estate typically appreciates during recessions (see chart above).

- Home prices will likely stay flat or appreciate slightly in 2023 (although low inventory, lower rates, and a tsunami of buyers entering the market could change that).

DEMPSEY GROUP IS GROWING!

I could not be more excited to announce that Sam Calhoun has joined the team! Sam is a Colorado native who grew up in Longmont. Her parents instilled in her a strong sense of financial responsibility, which led her to buy her first home on her own at 21. She loved the experience and considered real estate at that time, but decided to pursue a master’s degree in criminal justice and landed her dream job at Colorado Bureau of Investigation shortly thereafter. Today, she is an Army wife who lives in the east Denver metro area with her three young kids (7, 5, and 2). Real estate has been a vehicle for her to be present for her family, while also enabling her to have a fulfilling career, too. Sam’s strengths in negotiation, strategizing, and communication have made an immediate impact to the team and to our clients!

If you are looking for quick hits on the market, follow me on LinkedIn to get daily insight. If we can help you strategize your next steps in real estate in the Denver metro or elsewhere in the U.S., please reply or book a call with me!